STRONG CUSTOMER

AUTHENTICATION

What is it and how to achieve it

WHAT IS STRONG CUSTOMER AUTHENTICATION

Strong customer authentication is part of the revised Payment Services Directive (or PSD2), a package of measures introduced by European regulators, to help make online banking and payments more secure.

From 31 December 2020 in the EU (and 14 September 2021 in the UK), every electronic transaction will require strong customer authentication, except in a very few cases.

The changes will impact everyone: consumers, those who accept electronic payments, and those who provide payment and banking services in Europe and the UK.

KNOWLEDGE

Something the payer knows

Password, Pin memorable information

POSSESSION

Something the payer has

Pre-registered mobile phone, card reader, token

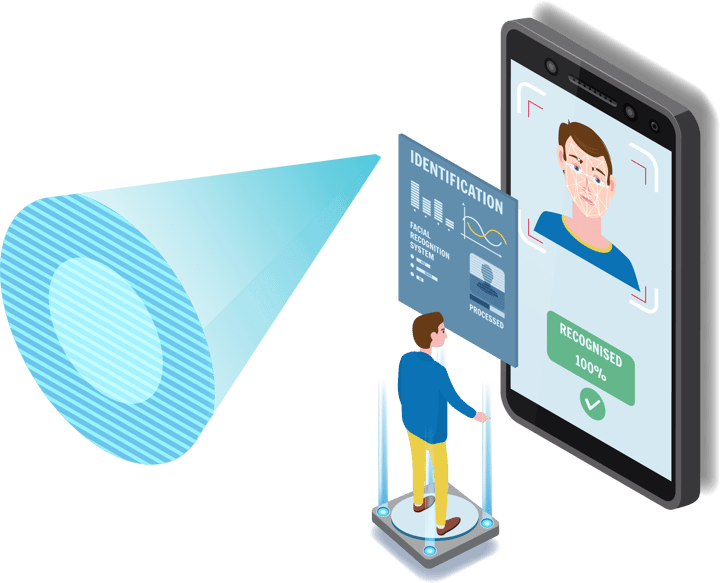

INHERENCE

Something the payer is

Fingerprint, iris scan, facial recognition

WHY IS IT SO IMPORTANT?

The new strong customer authentication requirements are a significant change to the current e-commerce model for card payments.

From 2021 strong customer authentication will be compulsory for every e-commerce transaction, unless an exemption applies. Secondly, the responsibility for authenticating customers will sit with service providers

(issuers and acquirers in the case of card payments), not merchants.

Increased

security

Lower

fraud rates

Higher

approval rates

CARDHOLDER AND MERCHANTS

Cardholders may be asked for additional information when they make a card payment online.

If the nature of the transaction is deemed as low risk by the card’s issuer, such as you always order a takeaway via the same company, on the same device, using the same card at regular intervals) then there will be no request for additional information – this is referred to as “frictionless flow”.

WATCH OUR ON-DEMAND SCA WEBINAR

Download nowLatest from our Blog

July 25, 2024 at 11:26 AM

PXP Launches Partner Portal to Elevate Partner Experience

PXP Financial, a leader in global payment services, is pleased to announce the launch of its Partner Portal. This ...

July 12, 2024 at 11:24 AM

The Future of Digital Wallets

The dynamic development of digital wallets has been astounding. Just a few years ago, they were seen as the future of ...

June 28, 2024 at 9:56 AM

Digital Wallets and Their Impact on Businesses

Digital wallets have transformed how businesses handle transactions, offering customers seamless, secure, and rapid ...