From 31 December 2020 (Europe) and 14 September 2021 (UK), the Second Payment Services Directive – or PSD2 – will be implemented and it is set to change the market hugely. PSD2 is a directive created by the EU countries to regulate payment services and providers in the European Economic Area (EEA). PSD2 has already been passed into law in most EU countries, including the United Kingdom.

The regulation impacts every part of the industry, including improving the security of online transactions and creating more competition by making banks open up access to customer data (with the customer’s permission, of course).

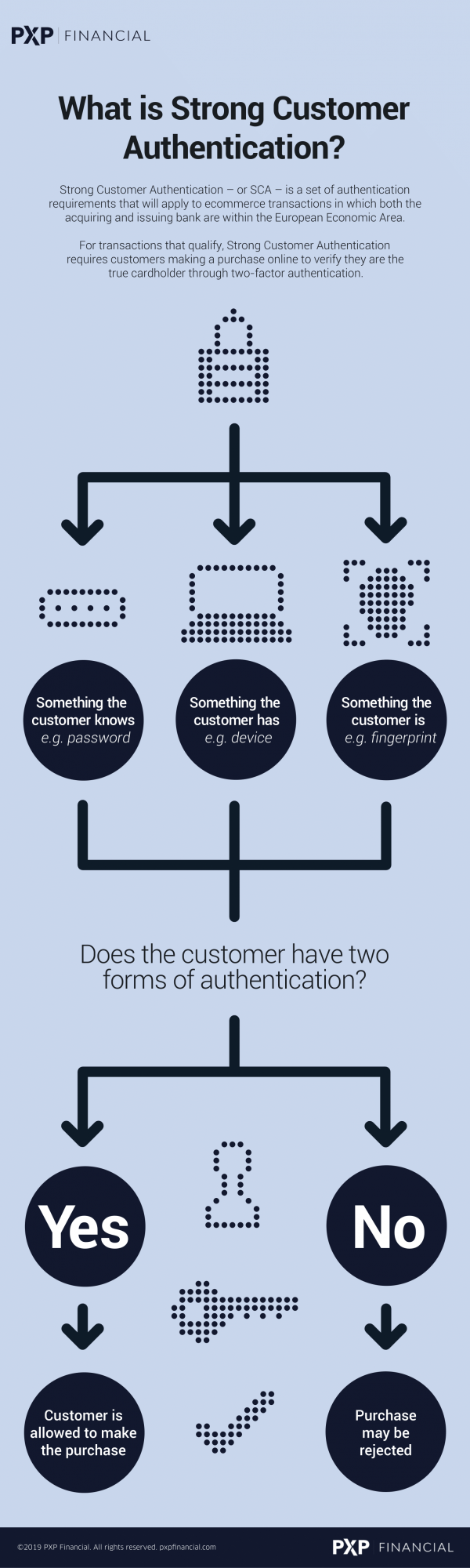

For merchants, the most important aspect of PSD2 is that online transactions will be subject to Strong Customer Authentication requirements from 31 December 2020 (Europe) and 14 September 2021 (UK).

©2024 PXP Financial. PXP Financial Registered Office: The Corn Mill - 1 Roydon Road - Stanstead Abbotts - Hertfordshire - SG12 8XL - United Kingdom

Phone +44 2038850598. PXP Financial is Authorised By The Financial Conduct Authority And Our Financial Services Register Number is 504318